Where Big Money Goes - Edition 02

Reshoring and China decoupling are redirecting capital flows, with Gold ETFs seeing record inflows & Private Equity taking the lead in a tepid M&A and IPO market. AI Compute remains the dominant theme

Welcome to the second edition of Where Big Money Goes—your go-to tracker for major financial moves across the globe.

This series, part of The Denominator, will spotlight the most significant capital flows, covering money movements above $500Mn across geographies, asset classes, and industries.

Our goal? To identify where the world's largest investors are placing their capital and uncover the sectors, companies, and trends driving today's economy. This monthly publication will highlight key money movements from March 22 to April 22, 2025.

Biggest Private Deal ever

OpenAI raises a $40Bn round at a $300Bn valuation led by SoftBank

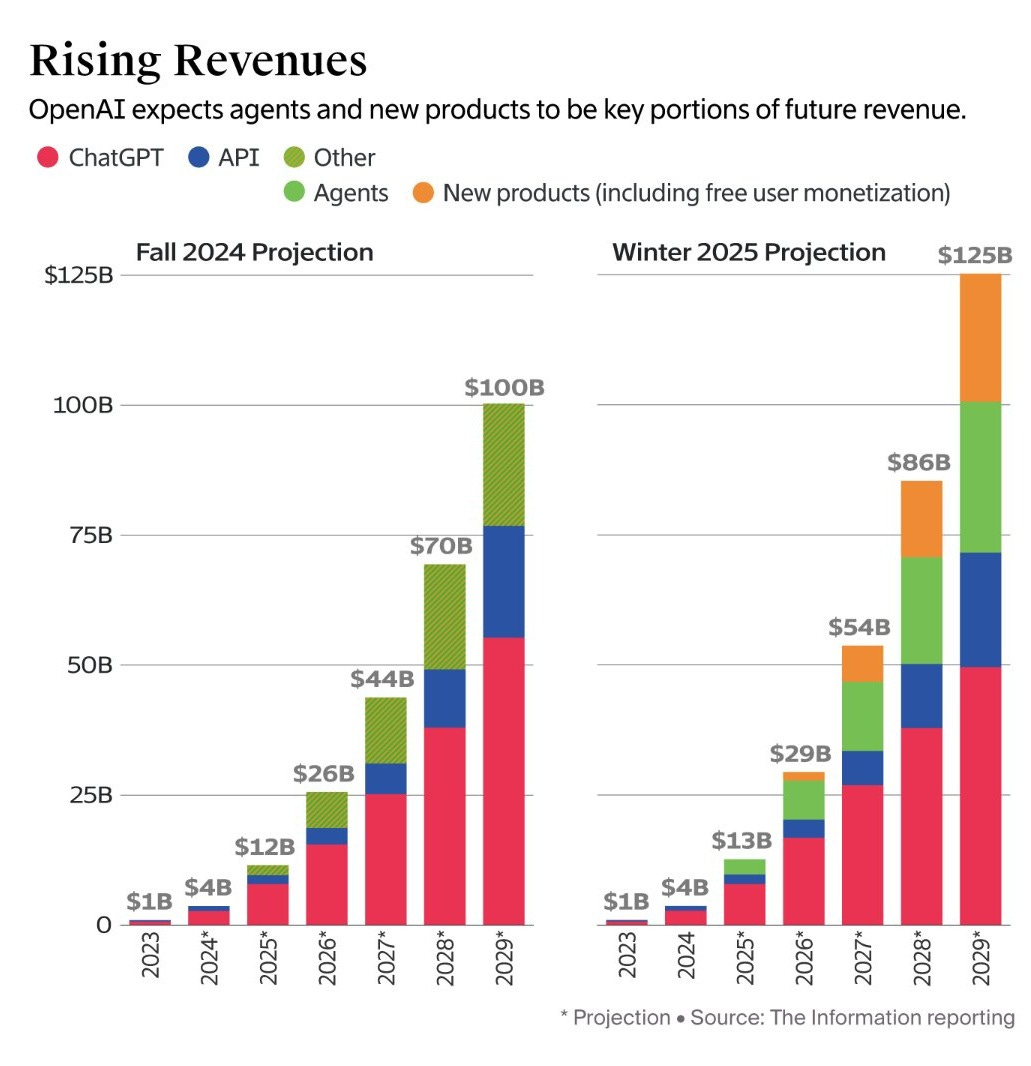

ChatGPT, OpenAI’s flagship product, now boasts over a billion users—nearly 10% of the world’s population actively using the company’s AI products.

The latest funding round was led by SoftBank, contributing $30Bn, with the remaining $10Bn coming from a mix of major investors, including Microsoft, Coatue, Altimeter Capital, and Thrive Capital. OpenAI is also projecting its AI-related revenues to reach $12.7 billion by the end of 2025.

Capital Moves

Founders Fund launches a new $4.6B fund

Founders Fund has closed a $4.6B growth fund, up from its previous $3.4B fund in 2022, signaling renewed VC bullishness. The oversubscribed raise drew 270 LPs and included significant GP capital. While active in AI, Founders Fund is also doubling down on defense tech with existing portfolio companies like Anduril, SpaceX, and Flock Safety.

Lone M&A move in Luxury sector

Prada buys Versace for $1.4B

The €1.25Bn ($1.37B) acquisition unites two of Italy’s most iconic fashion houses, significantly enhancing Prada’s position in the global luxury market. The deal is widely seen as a strategic move by Prada to strengthen its competitive footing against French giants like LVMH, enabling it to expand its brand portfolio, scale operations, and capture greater market share through vertical integration and synergies.

PE steers the biggest deals

GTCR exceeds top-tier PE returns with the Worldpay deal

PE fund GTCR sold Worldpay to Global Payments in a deal valued at ~ $24B less than 2 years after acquiring a 55% stake in Worldpay for ~$9B at an $18.5B valuation. Assuming the standard buyout structure of 30% equity and 70% debt, the transaction generated an internal rate of return exceeding 75%.

It’s a textbook case of private equity at its sharpest: where leverage, exit timing, and deep sectoral expertise in global payments combine to deliver exceptional returns for GTCR.

Thoma Brava buys Boeing’s digital aviation business for $10.5B

Thoma Brava, the leading PE firm has acquired significant portions of Boeing's Digital Aviation Solutions business for $10.5B in cash.

The deal includes key digital aviation assets and aligns with Boeing CEO Kelly Ortberg’s strategy to streamline operations and refocus on the company’s core aerospace and defense businesses. Thoma Bravo is financing the acquisition with $6B+ in equity and a $4B private loan led by Apollo Global Management.

J&J expands neuro footprint with $14.6B Intra-Cellular acquisition

Johnson & Johnson finalized its $14.6B acquisition of Intra-Cellular Therapies in April 2025 following regulatory and shareholder approvals. The deal adds Caplyta, an FDA-approved treatment for schizophrenia and bipolar depression to J&J’s neuroscience portfolio, along with a promising pipeline targeting major depressive disorder and Alzheimer’s-related psychosis.

Intel spins off Altera — Silver Lake bets on custom silicon for $8.75B

Intel is carving out its FPGA unit Altera, selling a 51% stake to Silver Lake at a $8.75B valuation.

Altera has lagged under Intel, but FPGAs are regaining relevance in AI inference and edge computing. Silver Lake sees long-term value in custom silicon beyond GPUs, with potential for a turnaround, IPO, or acquisition. Intel retains 49%, keeping skin in the game while freeing up capital.

This isn’t just a private equity play — it’s a long bet on the “next frontier of AI hardware” beyond Nvidia and Broadcom.

Adani Group Drives $10B AI Infrastructure Investment in India

The Adani Group plans to invest upto $10Bn to establish two large-scale data centers, each with an initial capacity of 1 gigawatt with likely states including Andhra Pradesh, Maharashtra, Gujarat, and Tamil Nadu. The company has identified major hyperscalers including Microsoft, Google, and AWS as key customers and aims to position India as a significant player in the global cloud infrastructure market.

Trump 2.0: The Onshoring Wave

From big pharma to autos, luxury goods, and advanced chip manufacturing, top executives across industries are racing to shift parts of their manufacturing and R&D operations to the U.S - a move aimed at aligning with President Donald Trump’s economic agenda.

Trump claims $7T in U.S. investments since taking office, but markets have remain unmoved by this figure. Investor focus has stayed on trade tensions and tariff uncertainty, which has continued to weigh heavily on equity and bond markets.

Nvidia Matches Apple with $500B U.S. AI Investment

Nvidia plans to produce up to $500B worth of AI servers and chips in the U.S. over the next four years, supporting the onshoring of advanced tech manufacturing. The intended impact is to reposition US as the major hub for advanced chip manufacturing.

Partners: TSMC, Foxconn, Wistron, Amkor, SPIL

Production Sites:

Arizona: TSMC is producing Nvidia's new Blackwell chips in Phoenix.

Texas: Foxconn and Wistron to launch AI supercomputer plants in Houston and Dallas within 12–15 months.

Apple Joins the AI Compute Race

Apple is reportedly spending $1B on AI infrastructure, as part of its broader $500B U.S. investment plan over the next four years, announced in February 2025. The spending is expected to be spread out rather than concentrated in 2025 alone.

NVIDIA will supply GB200 NVL72 systems (each ~$3.7–4M), forming the core of Apple’s AI compute power.

Supermicro and Dell will provide AI server integration, networking, and cooling infrastructure, ensuring seamless deployment.

While the bulk of spending is directed at NVIDIA’s cutting-edge chips, Supermicro and Dell play essential roles in building out Apple’s scalable AI backbone.

J&J joins Onshoring Wave with $55B Investment Plan

J&J plans to invest over $55B in the U.S. over four years—a 25% increase from the prior period focusing on manufacturing, R&D, and tech. The initiative kicks off with a new biologics plant in North Carolina, creating 500+ jobs. Key focus areas include cancer, immunology, neurology, and robotic surgery.

China Decoupling could hit U.S. private markets

Chinese state-backed giants like CIC are quietly stepping away from U.S. private equity, dialing back on fresh commitments and walking away from planned deals. Once billion-dollar backers of firms like Blackstone, Carlyle, and TPG, these LPs are retreating amid deepening geopolitical rifts and trade friction.

This isn’t just a diplomatic move—it’s a seismic shift for an industry already under pressure from discounted secondaries, over-leveraged portfolios, and sluggish fundraising.

With fewer LPs and mounting headwinds, the loss of Chinese capital could be a turning point for U.S. Private Equity industry unless another nation or SWF steps up.

Flight to Safety: Gold ETFs see over $8.5B in inflows

Gold ETFs and related funds saw $8.5B+ in inflows in March 2025, driven by surging investor demand amid trade uncertainty and a decline in the dollar’s safe-haven status.

North America led with $6.5B accounting for 76% of global flows while Europe and Asia added $1B each. During the same period, gold prices surged past the $3,000/oz mark, gaining a net 8.7% in the month and currently trading at ~ $3,289/oz levels.

That’s it for the second edition of Where Big Money Goes—your monthly guide to the biggest money flows across geographies, asset classes, and industries. Subscribe here for the latest editions of The Denominator.